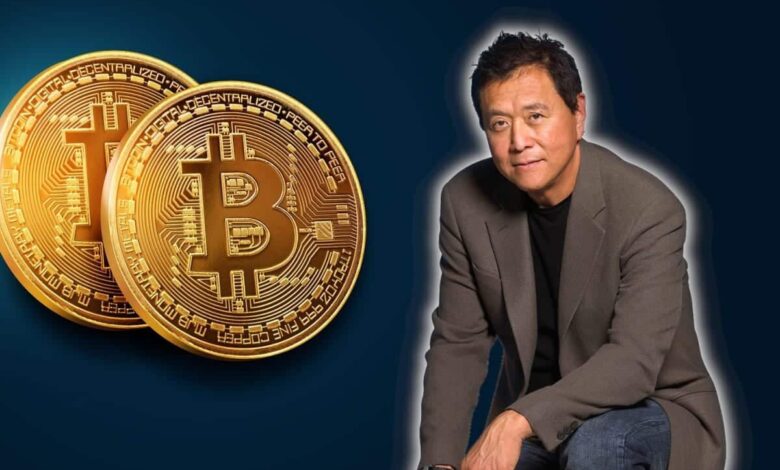

Robert Kiyosaki, the best-selling author of Rich Dad Poor Dad, has once again made headlines by revealing that he bought more Bitcoin and gold during what he calls a financial “sale” period. Instead of worrying about Bitcoin’s recent price drop, Kiyosaki saw it as an opportunity to double down on assets he considers safer than fiat currency.

In a recent statement on his X (formerly Twitter) account, Kiyosaki emphasized his belief that gold and Bitcoin are smarter investments compared to holding cash. He stated:

“WHY I bought more gold and Bitcoin? Owning gold and Bitcoin is smarter and safer than saving dollars.”

Preparing for the “Greater Depression”

Kiyosaki has long warned about an impending economic downturn, which he refers to as the “Greater Depression.” He believes that traditional education fails to prepare people for financial independence, often pushing them toward employment rather than entrepreneurship. To safeguard wealth, he strongly advocates for investments in Bitcoin, gold, and silver as hedges against inflation and economic collapse.

Bitcoin, Gold, and Silver as Wealth Preservation Tools

According to Kiyosaki, the economy is heading for a crisis where millions could lose their jobs, homes, and investments. He predicts that those who have followed his advice and diversified into Bitcoin and precious metals will be in a better position to withstand financial hardships.

Conclusion

Bitcoin has seen a decline of about 4.25% over the past few days, dropping to around $96,000 after briefly recovering $100,000. Despite market fluctuations, Kiyosaki remains optimistic, urging investors to use the dip as an opportunity to accumulate more Bitcoin and safeguard their wealth against future economic instability.

You said:

ChatGPT said:

Robert Kiyosaki Explains Why He’s Buying More Bitcoin

Why the “Rich Dad Poor Dad” Author Sees Bitcoin as a Safe Bet

A Strategic Move Amid Market Turmoil

Robert Kiyosaki, the renowned author of Rich Dad Poor Dad, has once again made headlines by revealing that he purchased more Bitcoin and gold amid market turbulence. While many investors panic during price drops, Kiyosaki sees such downturns as opportunities to accumulate assets that he believes are superior to fiat currency.

In a statement shared on his X (formerly Twitter) account, Kiyosaki reinforced his stance on Bitcoin and gold, emphasizing that these assets provide a safer alternative to traditional cash savings. He stated:

“WHY I bought more gold and Bitcoin? Owning gold and Bitcoin is smarter and safer than saving dollars.”

Kiyosaki’s belief stems from his distrust of fiat currency and central banking systems, which he sees as inherently flawed. With rising inflation, increasing national debt, and economic instability, he predicts that fiat money will continue losing value over time.

The “Greater Depression” and Financial Preparedness

For years, Kiyosaki has warned of a looming financial crisis, which he now calls the “Greater Depression.” In his book Rich Dad Poor Dad, he argues that traditional education systems fail to teach financial literacy, leaving individuals unprepared for economic downturns. Instead of solely relying on jobs and salaries, he advocates for investments in assets like real estate, businesses, and commodities such as gold, silver, and Bitcoin.

Kiyosaki believes that the world is on the verge of an economic collapse, driven by excessive money printing, inflation, and unsustainable government spending. He warns that millions of people could lose their jobs, homes, and investments if they do not take proactive steps to protect their wealth. To safeguard against this potential crisis, he advises people to invest in “real money” assets rather than holding depreciating fiat currency.

Bitcoin, Gold, and Silver: The Best Hedges Against Inflation

Bitcoin, gold, and silver have long been considered safe-haven assets during economic uncertainty. Unlike fiat money, which can be printed endlessly by central banks, these assets have a limited supply, making them more resistant to inflation.

Kiyosaki sees Bitcoin as “digital gold” because of its decentralized nature and scarcity, with a maximum supply of 21 million coins. He believes this gives Bitcoin an advantage over traditional currencies, which can be devalued through inflationary policies. Additionally, gold and silver have been trusted stores of value for centuries, offering stability when stock markets and fiat currencies fluctuate.

“The rich do not work for money; they make money work for them.” — Robert Kiyosaki

Kiyosaki frequently reiterates that those who understand the financial system and make strategic investments will benefit the most during economic downturns. He argues that those who solely rely on savings in fiat currency risk losing their purchasing power as inflation erodes the value of their money.

A Market Crash or an Opportunity?

Bitcoin has recently faced significant price fluctuations, shedding roughly 4.25% in value over the past few days. After briefly recovering the $100,000 level, Bitcoin was trading around $96,000 at the time of writing. Many investors panic when Bitcoin experiences sharp corrections, fearing further losses. However, Kiyosaki sees such dips as buying opportunities rather than reasons to sell.

His investment philosophy aligns with the well-known principle: “Buy low, sell high.” When the market is in fear and prices are down, he believes that smart investors accumulate assets that will appreciate in value over time. This contrarian approach has helped many seasoned investors build wealth during economic downturns.

Conclusion

Robert Kiyosaki remains steadfast in his belief that Bitcoin, gold, and silver are the best tools for wealth preservation. While traditional investors might be hesitant to buy during market corrections, Kiyosaki encourages people to take advantage of lower prices to accumulate more Bitcoin.

As the global economy faces uncertainties, inflation rises, and central banks continue to print money, Kiyosaki’s warning of a “Greater Depression” resonates with many. Whether his predictions come true or not, his advocacy for financial education and strategic investing serves as a valuable lesson for those looking to secure their financial future.